City Council filed the FY 25-26 Annual Budget with the City Secretary on August 7, 2025.

A Public Hearing for Budget & Tax Rate, Adopt Budget and Proposed Tax Rate is September 4th, 2025 at 6 PM

City Council Voted to Ratify Tax Rate is September 4th, 2025 at 6 PM

Meeting location is Nolanville City Hall, 101 North 5th Street, Nolanville Texas 76559

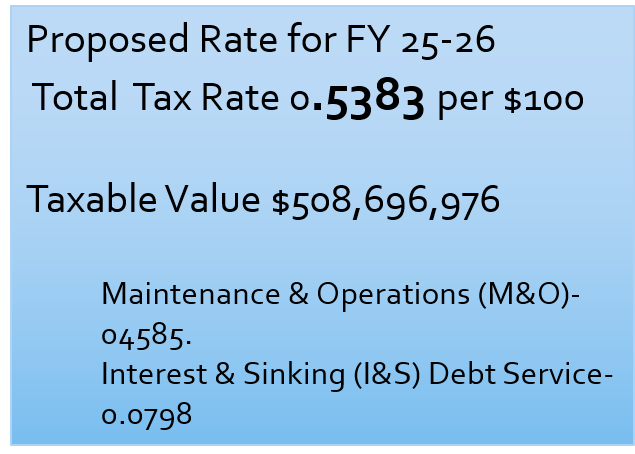

FY 25-26 Calculated Rates

No New Revenue Total Tax Rate: .5262

Voter Approval Total Tax Rate: .5383

Di minimis Total Tax Rate: .6165

Voter Approval M&O Rate: . 4585

Interest & Sinking Rate: .0798